In this lesson you will learn 💸

- How your attitude to risk translates into your investments

- How you can diversify your portfolio

- How your mindset can trick you into investment errors

How does your risk appetite translate into your investments?

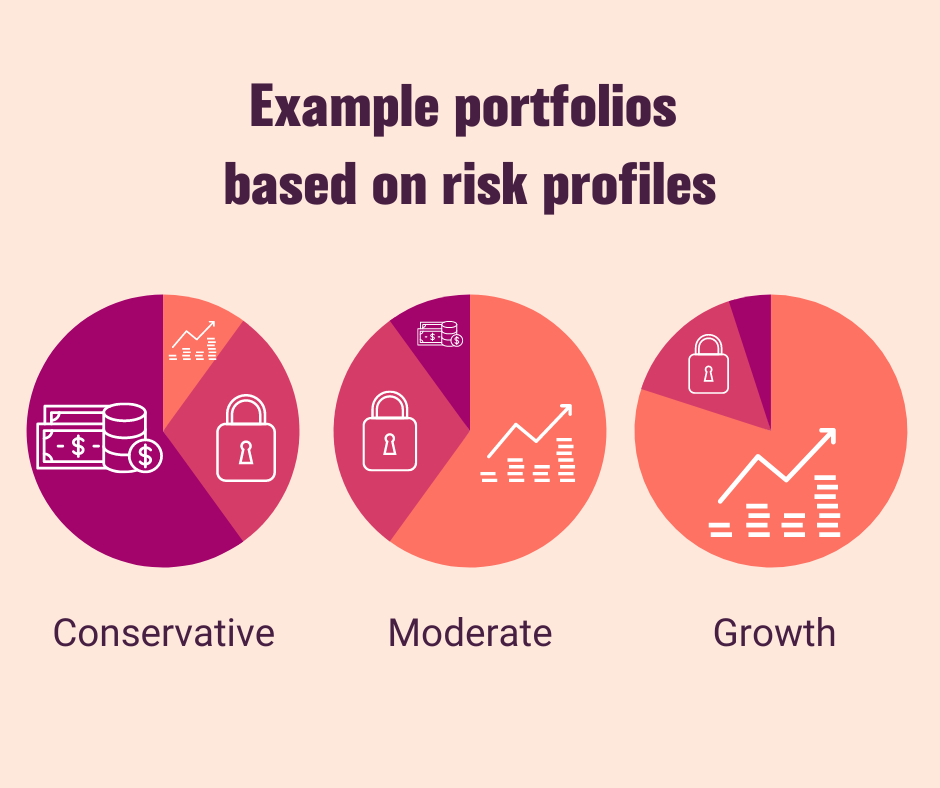

When you invest, you will translate your personal risk profile and your preferences into a portfolio.

As different groups of investments (asset classes) behave differently when it comes to risk and return, the proportion of what and how much is included in your investment influences the risk and expected return overall.

These are of course simplified and illustrative portfolios. In a nutshell you see that they consist of stocks, bonds and cash and that the more growth wanted, the more stocks, which in this case is the asset class with the highest risk but also the expectation for high returns, is included.

In real-life, you might have a number of additional asset classes such as real-estate, commodities etc. in your portfolio based on your risk profile and your preferences.

Tip📌

When setting up your investment, think about:

- Your overall objective: growth or income

- The timeframe you set for yourself

- The themes and topics that are important to you

If you select a fund or invest with a robo- or human advisor, they'll recommend a so called 'asset allocation' to you, that is in essence the way your portfolio pie should look like based on your preferences and risk profile.

How can I diversify my portfolio?

To diversify your portfolio means including different geographies, industries, asset classes, potentially currencies.

Research has shown, that for long-term investing a diversified portfolio shows better results than one that is investing into for example one industry.

Tip📌

When you are selecting a fund or ETF, check in the documentation (factsheet) what geographies and industries are covered. Usually they show you this in %. Maybe if your preferred product might show 50% or more being invested in one particular region, that might not be something you're after.

The tricks your mind can play on you when investing

Imagine you find 1,000 of your local currency on the street. Would you rather spend it or invest it?

The answer lies in behaviour finance. By the way, most people would spend it😉

There are over 40 different biases that can influence your judgement towards an irrational investment behaviour. Here is a short selection to be aware of:

- Loss-aversion bias is when you prefer to avoid a loss than to make an equivalent profit, for example when faced with a choice of avoiding a loss of 1,000 or making a profit of 1,000. Why is that a problem? It causes us to avoid small risks even when they're probably worth it and is one of the reasons why some people prefer to save, rather than to invest.

- Familiarity bias is the tendency that we prefer to invest in things or geographies we know, which can cause a lack of diversification.

- Herd behaviour bias is when you follow others when investing rather than making your own decisions based on data.

- Overconfidence bias is the tendency to see ourselves better than we are. It causes errors in seeing and managing risks.