Turn your employees into financial superheroes

Join the growing number of companies already witnessing the transformative impact of SmartPurse financial wellness on productivity and employee well-being

Why partner with SmartPurse?

- Elevate workplace productivity. Mental health is tied to financial health. Good mental health results in greater work productivity.

- SmartPurse is the only completely independent, unbiased financial education platform offering localised, country-specific content.

- Our solution is based on research. It drives wellbeing that’s inclusive, sustainable, and practical.

40%

of employees rate money as a top stress factor. Unlock peak performance - invest in their well-being, empower your team to thrive.

13hrs

a month lost to each employee worrying about finances - at work. Reclaim employee productivity with SmartPurse.

79%

trust their employer for advice on planning, saving and investing. Make retaining top talent a breeze with a simple fix - SmartPurse.

You are in good company

Many businesses are already taking advantage of award-winning financial education services

How can you work with SmartPurse?

Financial Wellbeing Workshop

In-person talks or digital webinar sessions. We cover all topics of personal finance, from money mindset to budgeting, investing, pensions and crypto. Outcomes for participants are greater financial literacy and confidence in money management.

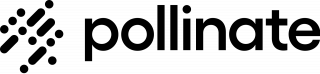

Money School via Web & Mobile App

An interactive learning platform, employees will have convenient access to tutorials, recordings, 80+ money lessons, checklists, and calculators for convenient self-paced and self-directed learning.

Tailor-made financial wellness programs

We measure your team's financial wellness with our unique financial health index and design a tailor-made program for maximum effectiveness based your organisations culture and unique circumstances.

One-Off Corporate Talks

Whether it’s for your corporate team, a women’s group, or an offsite, we specialise in curating engaging sessions that leave a lasting impact.

Brand Partnerships

Whether it’s crafting branded content for your distribution to event collaboration, we’re here to amplify your brands’ impact through the lens of financial education. Let’s redefine the narrative together.

We could not have wished for more!

Why SmartPurse?

Engaging education that sparks results

95%

Increase their financial confidence

9 out of 10

Optimise their retirement

72%

Start investing

Unbiased

All our contents are advertising and affilliation free.

Proven results

Our financial education is designed around people and leads to measurable increase in your employee's financial health and confidence.

Inclusive

Originally designed for women, with growing demand we have expanded our education offering to all audiences proving inclusive experiences where everyone feels welcome.

Join other productive, inclusive and talent retaining companies now