In this lesson you will learn 💸

- What a budget is

- What tools you can use to set up your budget

What is budgeting?

Budgeting is the process of creating a plan to spend your money. Your budget usually operates on a monthly basis and details all the income and expenses in your current financial situation.

What should I include in my budget?

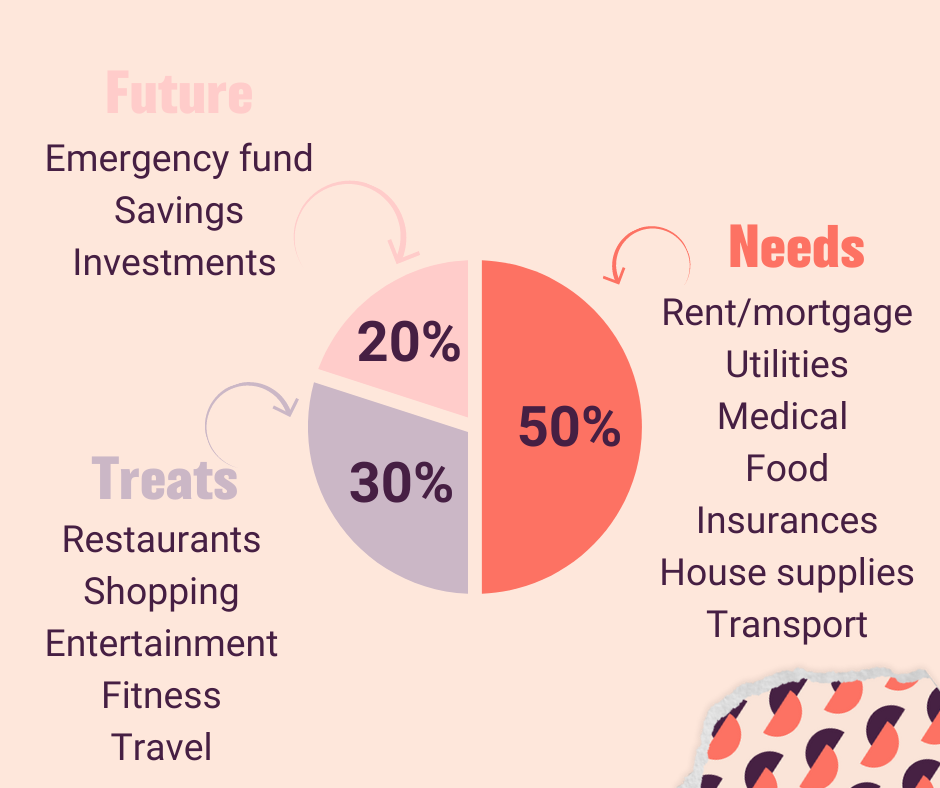

Remember the 50-30-20 rule? Here are some examples of what should go into your budget:

How often should I review my budget?

- When starting a budget for the first time, you should get into the habit of reviewing it pretty regularly, e.g. monthly.

- Keep track of your budget with a budgeting app, in your e-banking account or in a spreadsheet.

- Once you get into the habit of budgeting, it makes sense to do a larger review every three months or at least once a year.

Tip 📌

One of the easiest ways to review your budget is when you're checking your bills and direct debits.

Budgeting tools ⚒️

We’ve looked at lots of free budgeting apps and online tools, and here are some that we think are worth your time specific for Switzerland:

- App and templates of Budgetberatung

- BudgetAlarm fromK-Tipp

- Caritas MyMoney App

- Toshl Finance (costs a fee, recommended by many course participants)

- Pennies App

If you prefer a good old excel spreadsheet, find our budgeting calculator next.

SmartPurse Calculator: Budget like a Pro

Please login

Our contents are completely advertising free.

To benefit from full access to all of our lessons and webinars, please upgrade your account.

or join one of our live webinars with included 1 month premium access pass.

VIP Coaching is also available for

Your action 📝

- Pick a budgeting tool (app, card, spreadsheet).

- Set up your budget.

- Decide how frequently you want to re-visit your budget and either create auto-alarms or calendar reminders to make the necessary time.