In this lesson you will learn 💸

- Why it's really important to start early

- How to catch-up

Planning for retirement is essential for all of us

Estimates show that pillar 1, the state pension (AHV) and pillar 2, your workplace pension will only cover around 60-70% of our needs in old age.

However, since your costs might not really decrease when you are old, there are "pension gaps" that hit women particularly hard.

Only 17% of women and 28.9% of men receive contributions from all three pillars.

BFS, Armut im Alter

What are the consequences of pension gaps?

- Less monthly payments than you hoped for

- Insufficient funds to finance your desired living standard

- Potentially you have to move to a smaller apartment or a different location

- Limited or no option of early retirement - you may even have to continue working after you official retirement age

The good news - pension gaps can be avoided and filled

In chapter 2 of this module, you'll find all the practical information and tips how can avoid and mitigate pension gaps.

But first, here's the good news. Even with smaller amounts, the earlier you start, the easier it is.

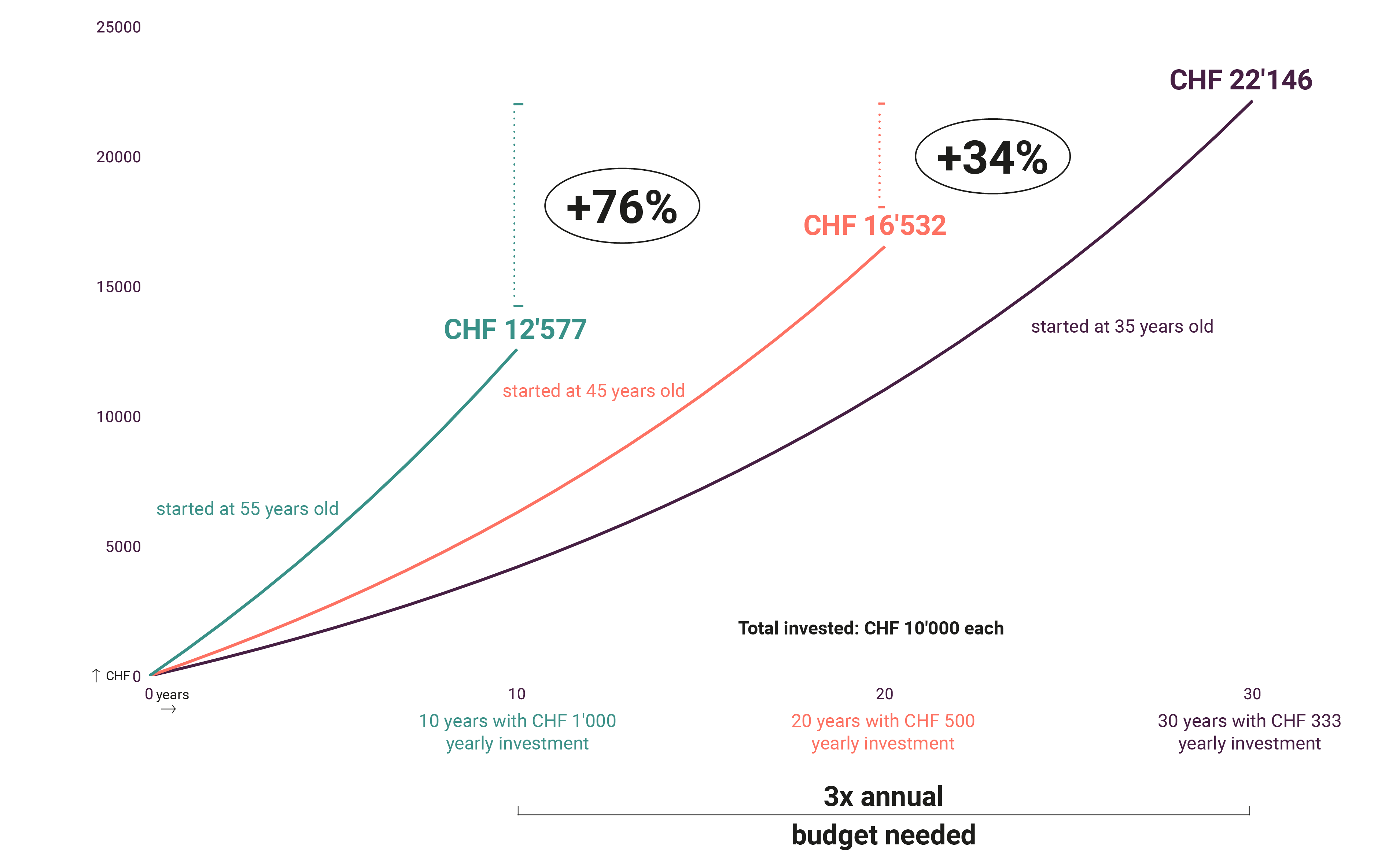

We calculated the benefit of an early start with a simple model:

- 3 people (women in our example) invest the same amount of CHF 10,000

- They start at different periods: 35 years, 45 years, 55 years

- We have assumed that they are moderate investors and generate 5% per year, not counting inflation

Here is what the model revealed:

- The earlier you start, the greater the outcome: The 35-year-old woman achieves the highest return, 76% more than if she had only started 20 years later at the age of 55.

- The earlier you start, the smaller the amounts you need per year: the 45-year-old woman only has to invest half as much per year as the 55-year-old woman to achieve the same outcome.

- Starting at a later stage still pays off: the 55-year-old woman has to spend higher amounts per year than if she had started at 35, but can still improve her situation significantly compared to just saving with little or no interest.

Should I start, even if I am 55 now?

Yes! Since our life expectancy is increasing, it is also worth starting at 55 or later.

Remember, statistically you still have 22+ years from the official retirement age, that's a long time that you can use to put your money to work!

The sooner you start, the more time and compound interest you get when investing (and when savings accounts start earning interest again). But even with only very small amounts and only saving without investing, you can improve your situation in old age:

Now you know why it's worth not putting off your pension. Do you know how much you and your employer pays into your pension fund each month? And how much pension can you expect at the end? In the next lessons we take you step by step on the way to your optimal pension.