Negative Interest Rates: the very name suggests you should avoid them, but as with everything else in the financial world, the meaning is so much more complicated.

To understand a negative interest rate, you have to build off of a standard interest rate. This is the percentage used to calculate how much you’ll be charged each month for taking out a loan, or how much you’ll receive for holding your savings in the bank. Interest Rates are set by ‘Central Banks’ (which in Switzerland is the Swiss National Bank). Rates depend on your personal situation (the amount you’re borrowing, the duration of your loan), but also on the things you can’t control - the state of the economy.

If the economy is struggling, Central Banks will lower the interest rate. This means commercial banks (UBS, Credit Suisse, AIG Private Bank...) can take more money from the Swiss National Bank, and thus give larger, longer, and more loans to their customers. The more loans a person can take, the more they can spend, and so theoretically, our - borrowed - spending money revives the economy. However, if this was to continue unchecked, Switzerland would begin to see an unsustainable rate of inflation, leaving the value of money absolutely worthless.

To stop this happening, the Central Bank will raise interest rates, meaning loans become lower, shorter, and, you guessed it, few and far between. Visually, the whole thing works like an old fashioned pan balance: inflation weighs down one end, deflation the other, and interest rate is increased or decreased as needed to keep the economy in balance.

Figure 1

At the height of their 2009 Hyperinflation, Zimbabwe circulated ‘one hundred trillion dollar bills’, the most zeroes of any legal tender in all recorded history. At one stage, this note would not even cover a bus fare.

Currently, Switzerland's interest rate is already in negative rates, at -0.75. In the UK, the Bank of England (their Central Bank), has lowered interest rates to just 0.1% - their lowest rate in history. The word ‘kickstarter’, which has been thrown around lately, explains exactly what these rates are meant to do: kickstart the economy. But with the pandemic rewriting the rules of spending, the question on everyone’s lips is whether people should be rushed to regain ‘an appetite to spend more when many are worried about their jobs and long-term finances’.

Surely it doesn’t make sense to place the responsibility of reviving the entire UK economy on the shoulders of those still suffering from its fall? But if a recession continues, there are already predictions that the UK will shift into negative interest rates, and so the question is, do we want that to happen?

The Good

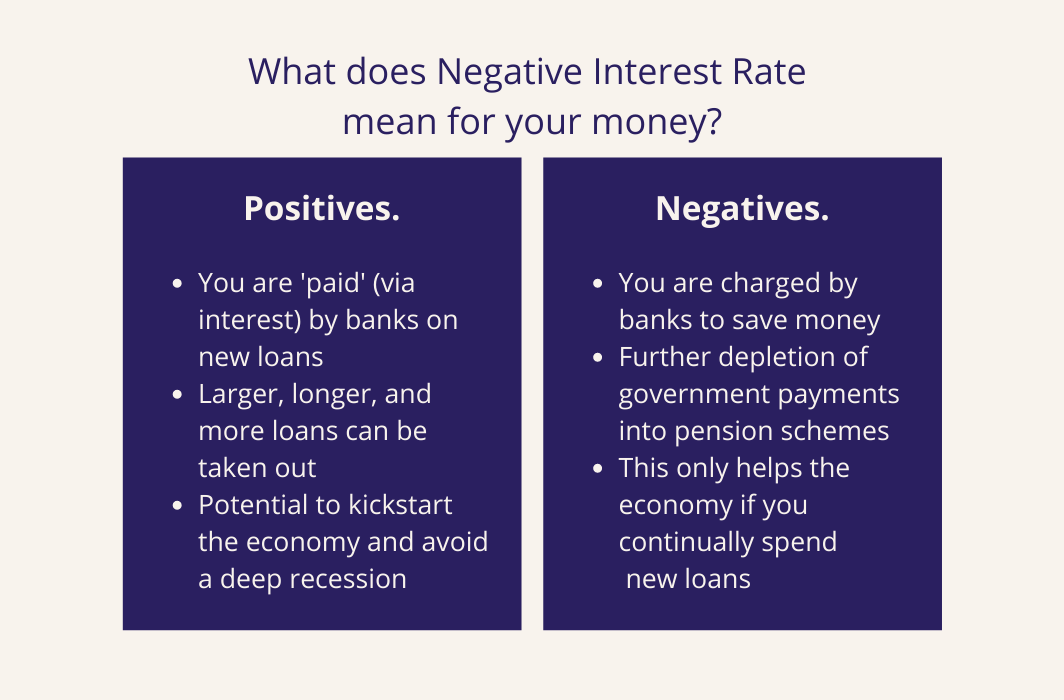

In the game of negative interest rates, the government always wins big. Functioning largely on loans, the government runs a huge deficit, and so, with interest on loans literally in the negative, they would catch a huge break on payments. A break so big, they would be paid for being in debt - sounds dreamy, right?

In the same way, we could benefit from negative interest rates - though on a much smaller scale...

For example:

In the UK, a personal loan of £1,000, to be paid off in 2 years at their current interest rate, 0.1%, would result in £12.03 interest each year. If the UK were to shift to a -0.1% rate, you would be paid £12.03 each year - effectively meaning your debtor is paying off your debt. But if you’re thinking that this sounds too good to be true, that’s because, in many ways, it is.

The Bad

There’s a lot of negatives to negative interest rates, ironically. For one, the idea of being paid for your loans is good for you, but bad for banks. If negative interest rates are introduced as a short-term solution, then fine, banks might choose to ‘absorb the cost to save the economy’. But if it’s a longer-term solution, they will simply introduce banking fees. Which means your newly found interest will go straight back into the bank in the form of additional charges.

Plus, the whole scheme is a way to revive the economy - so if you don’t immediately start spending your increased loans, the economy remains in a recession, and we fall into a state of limbo - a state of limbo in which you’re having to pay to save, at that. Paying to save sends out the message that the UK does not care unless the population is spending money to line the pockets of the rich, proving once again that the trickle down economics system is a wholly flawed one.

Negative Interest and National Pensions

The Independent draws the eye to the ever-pessimistic trend our National Pension Scheme has been following. Currently, ‘a representative pension pays around 4.9% for every pound in the pension pot’, compared to 8% in 2007. ‘This will only get worse in a negative rate environment’, they explain, meaning that while you’re taking out more loans - which inevitably will need to be paid back, less and less money is being put aside for your retirement.

It’s as though negative interest rates hide their adverse effects in long-term consequences, hoping we won’t notice them. In a day, you have easier access to loans, and you’re even paid to take them out - brilliant! But in a week, you’re having to pay to save money. In a month, your pension is falling by the second, and you don’t know when retirement will be a viable option. Then what happens in a year, when the economy is still floundering - afterall, we’re not seeing positive results from a 0.1% interest rate, so how much more good could a negative figure bring.

The Future for the UK

Sir David Ramsden, Bank of England Governor Deputy, has admitted to The Evening Standard that ‘at present, negative policy rates would be less effective as a tool to stimulate the economy’. But really, when has ‘less effective’ ever stopped the government before? In fact, despite his comments, ‘future markets still think there is a 50:50 chance’ negative rates will be introduced by February 2021.

Whichever way this goes, negative interest rates clearly don’t have a strong reputation. Take Japan for example, which went ‘Negative’ back in February 2016, and has seen few - if any - positive impacts (Figure 2). Negative rates may help the economy endure a recession, but when it comes to getting out of one, they do far more damage. Read any recent article on the ‘threat’ of looming negative interest rates for the UK, and you’re sure to catch the drift of public opinion from the comments:

Tell me when [this begins], and I withdraw all my money and put it under the mattress.

Discover more

-

Protecting your financial future in times of crisis

Do you know how your money’s protected in an emergency and what you can do now for your future and security? With these 9 points y... -

Want to create your own financial plan? Here are 7 simple steps...

What do you want for tomorrow? In five years? Ten years? A financial plan helps you to create order. It provides you with security... -

Follow these 6 tips to find the financial expert that is right for you

When do you need financial advice? How do you find someone you can trust? What should you be aware of when selecting your advisor?...