Do you want to invest smarter and benefit from the future?

Shape your financial future with the Smart All World ETP - innovative, flexible and diversified. Your smart entry into the megatrends of tomorrow.

Launching February 25th 2025.

The Smart All World ETP is for anyone who wants to invest in the future today

Highlights

- Focus on future topics: AI, robotics, renewable energies, cryptocurrencies, ideal for long-term wealth accumulation

- Broad diversification: equities, bonds, commodities and digital assets

- Sustainable themes: Support for ecological innovations.

- Cost-efficient: Only 0.50 % management fees p.a.

- Simple & flexible: Suitable for savings plans or one-off investments.

Invest in a portfolio built for the future

Why should you invest now?

- Stay ahead of the curve: With the Smart All World ETP, you are betting on the most exciting mega trends that will shape the world of tomorrow.

- Diversity meets innovation: Combine the stability of traditional investments such as bonds and commodities with the growth potential of future-oriented sectors.

- Innovative sustainability: Invest in companies and technologies that actively contribute to the ecological transformation.

How can you use the Smart All World ETP?

Basis for your portfolio

A broadly diversified all-weather investment that serves as a stable foundation for long-term wealth accumulation.

Foundation for your future

A versatile investment for everything that is important to you in the long term - perfect for a children's portfolio or your retirement provision.

Innovative Addition

Benefit from industries such as AI, robotics, renewable energies and digital technologies that will shape the world of tomorrow.

Easy

Whether with small amounts or savings plans - the cost-effective structure make it easy to get started.

Time-saving

Invest effortlessly in future themes, commodities and digital currencies - without time-consuming research.

Diversified

Innovative mix of commodities, equities, bonds and cryptocurrencies for optimum diversification

Your Smart All World ETP at a glance

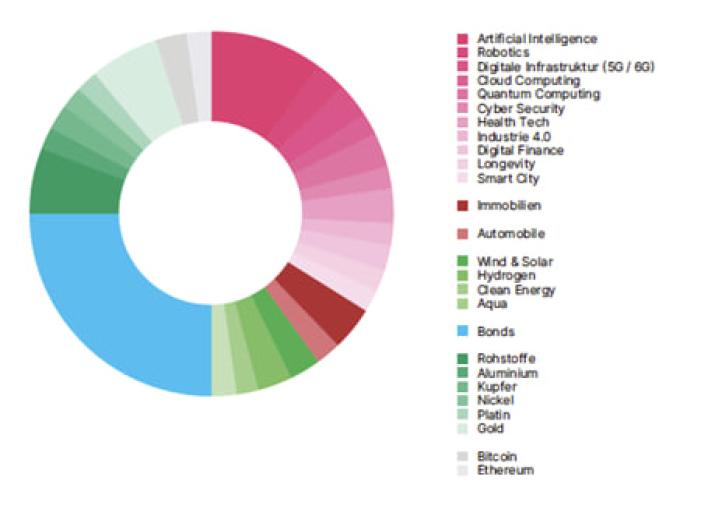

- Shares Future topics (40%): AI, robotics, cloud computing, cyber security.

- Sustainability shares (10%): Renewable energy, clean energy, water management.

- Bonds (25%): Global bonds for stability and regular income.

- Commodities & precious metals (20%): Aluminium, copper, nickel, gold, platinum.

- Krypto-Assets (5%): Bitcoin, Ethereum.

The Smart All World ETP has been designed to outperform a traditional world ETF with balanced volatility.

In the backtest, it would have achieved an impressive return of 118% over the last 5 years - a strong result that emphasises the power of its innovative and diversified strategy.

- Issuer: Maverix Securities

- AGProduct type: Exchange-traded product

- Underlying: Smart All World Index

- Currency: CHF

- Dividends: Retained

- Listing: SIX Swiss Exchange

- Issue price: CHF 100.00

- Collateralization: SwissQuote Bank SA

- Management fee: 0.50 % p.a.

- Initial fixing: January 21, 2025

- Valuta: January 23, 2025

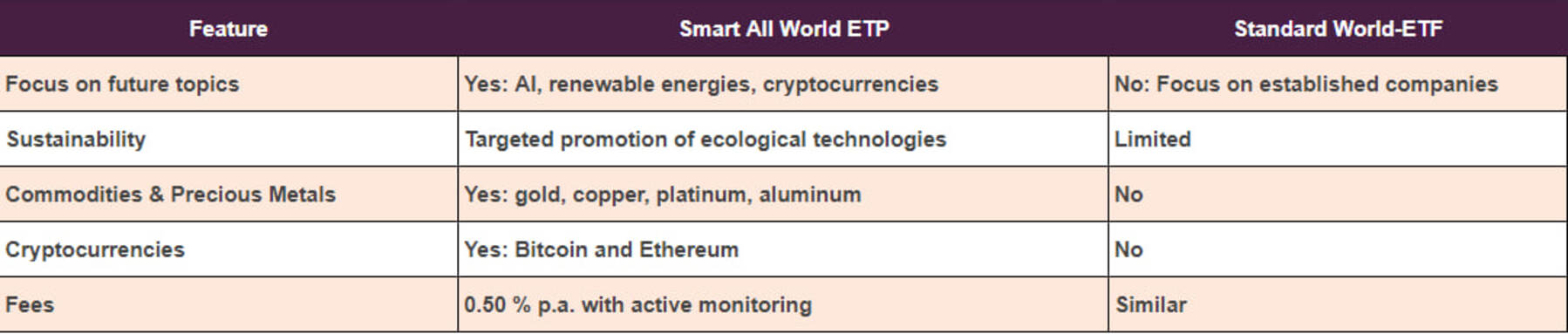

The alternative to conventional world ETFs

What our investors say

I co-created this product to have an alternative to traditional world ETFs for my children - and I am invested myself.

FAQ - Frequently asked questions about the Smart All World ETP

Why is the Smart All World ETP better than a standard world ETF?

The Smart All World ETP combines traditional diversification with a focus on future themes such as AI, sustainability and cryptocurrencies.

Can I also invest small amounts?

Yes, you can start with a savings plan from small amounts.

How high is the risk?

As with all investments, there are risks. Thanks to broad diversification, however, the risk is minimized.

Why are cryptocurrencies included?

Bitcoin and Ethereum offer potential for above-average returns and round off the future-oriented portfolio.

How sustainable is the ETP really?

The product invests specifically in companies and technologies that actively contribute to ecological transformation.

What is the Smart All World ETP?

The Smart All World ETP is an exchange-traded product (ETP) that offers private investors a simple and effective way to diversify their assets across different asset classes. The focus is on future themes such as artificial intelligence, robotics, mobility, sustainability and renewable energies as well as metals of the future, gold and cryptocurrencies such as Bitcoin and Ethereum.

Who is this product suitable for?

The product was specially developed for long-term investors who want to secure or build up their assets over a period of 15-20 years, either for themselves or for their children. It is suitable for both regular savings plans and one-off investments.

In contrast to traditional indices such as the MSCI World, which focuses primarily on established stock markets, this product offers a future-oriented focus.

This ETP is ideal for investors who recognize that the world is constantly changing and that these changes should also be reflected in the composition of their portfolio. With a focus on themes such as artificial intelligence, renewable energy and cryptocurrencies, the Smart All World ETP provides access to the key trends of tomorrow and creates a solid foundation for sustainable growth.

How has the Smart All World Index performed historically compared to a standard all-world index?

The historical performance of the Smart All World Index shows that it has outperformed a standard all-world index over the long term. The Smart All World Index has significantly outperformed the standard all-world index, particularly due to its focus on future themes and sustainable technologies. This underlines the index's potential to achieve above-average growth by focusing on innovative and forward-looking sectors. (see also the factsheet on page 2).

Which asset classes does the index cover?

The Smart All World ETP index is made up of the following asset classes:

- Shares of the future (40%): Technologies such as artificial intelligence, cloud computing and cyber security.

- Sustainability shares (10%): Renewable energies such as solar and hydrogen.

- Bonds (25%): Global bonds to minimize risk.

- Raw materials (20%): Strategic metals of the future such as copper and lithium, as well as the precious metal gold.

- Cryptoassets (5%): Bitcoin and Ethereum for future-oriented diversification.

What are the main features of the product?

- Valor: 135301671

- ISIN: CH1353016715

- Management fee: 0.50 % p.a.

- Currency: CHF

- Stock exchange: SIX Swiss Exchange (tradable on each trading day)

- Issuer: Maverix Securities AG (with collateral from Swissquote)

How can I buy the ETP?

The ETP is available for subscription until 20.01.2025 and can be subscribed via any custodian bank. Please call your advisor. We recommend subscribing via Swissquote. Thereafter, the ETP will be listed and can therefore be bought or sold on the SIX Swiss Exchange every trading day. Over-the-counter trading is also available.

What are the advantages of the Smart All World ETP?

- Simple handling as with classic ETFs.

- Access to global markets and future key themes.

- Broad diversification with a focus on innovation and sustainability.

Start now!

Actively shape your financial future with the Smart All World ETP - simple, flexible and future-oriented.