In this lesson you will learn 💸

- What financial planning is all about

- How you can set achievable and realistic goals for your finances

Watch the short video to get started:

Structure your goals

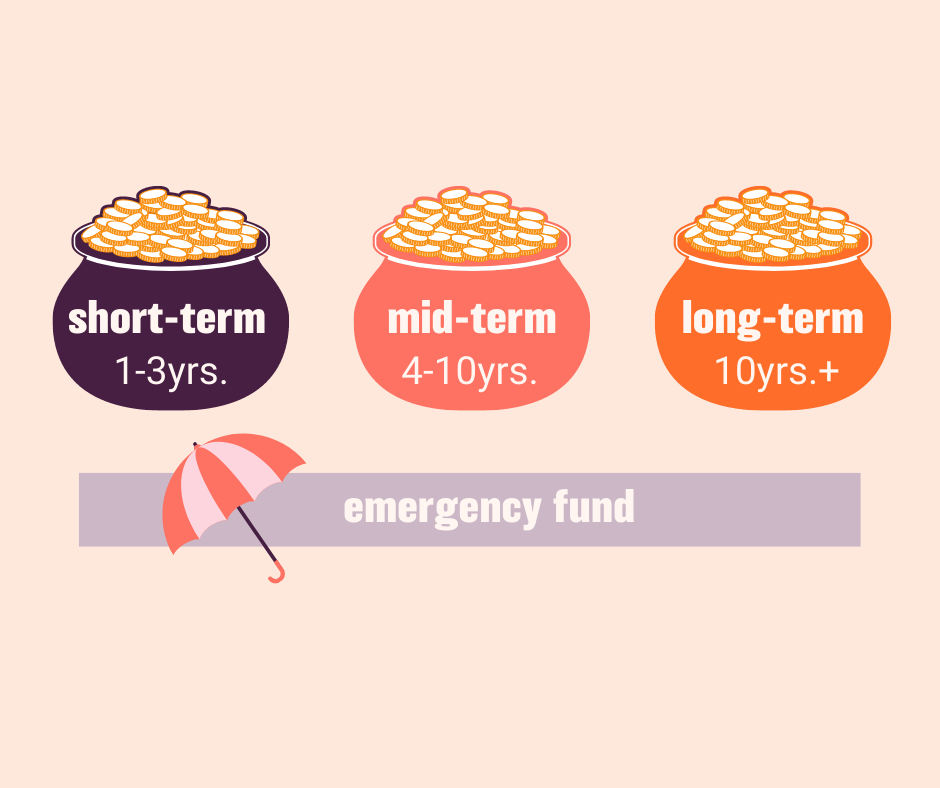

To plan your money and to make it easy to define what you want to invest, think about your goals in three different time-horizons:

How to set realistic goals?

Don't worry, we will look at the amounts you might need in lesson three of this chapter 😉

The easiest way to make sure that your financial goals are realistic is to link them to your life stage. There are three different categories to consider for this:

- Short-term goals (1-3 years): These will define how much money you need available at hand (liquid). They could include finding a new job, paying off credit cards, or building up an emergency fund.

- Medium-term goals (4-10 years): These could include taking a career break, starting a business, or saving for a new car.

- Long-term goals (10+ years): These could include early retirement, buying real estate, or sending your children to university.

Your action 📝

Take a piece of paper and note down your short-, mid-, and long-term goals and any special goals you might have.

No need for perfection here, simply put down what comes to mind. We'll put it all together in lesson four 😊

Ready to test your knowledge?

Finish this lesson and get rewards🏆

Take the quizGreat job on passing the quiz! You're welcome to take it again, but the coins you earned are a one-time reward😉

Take the quiz to wrap up the lesson