In this lesson you will learn 💸

- How to define your investment objectives

- How to assess and compare different financial providers

- What to look out for when choosing ETFs and funds

- How to figure out if a human advisor is a good fit for you

What should your investment do?

Your choice of product and provider will be dependent on what your want your investment to achieve.

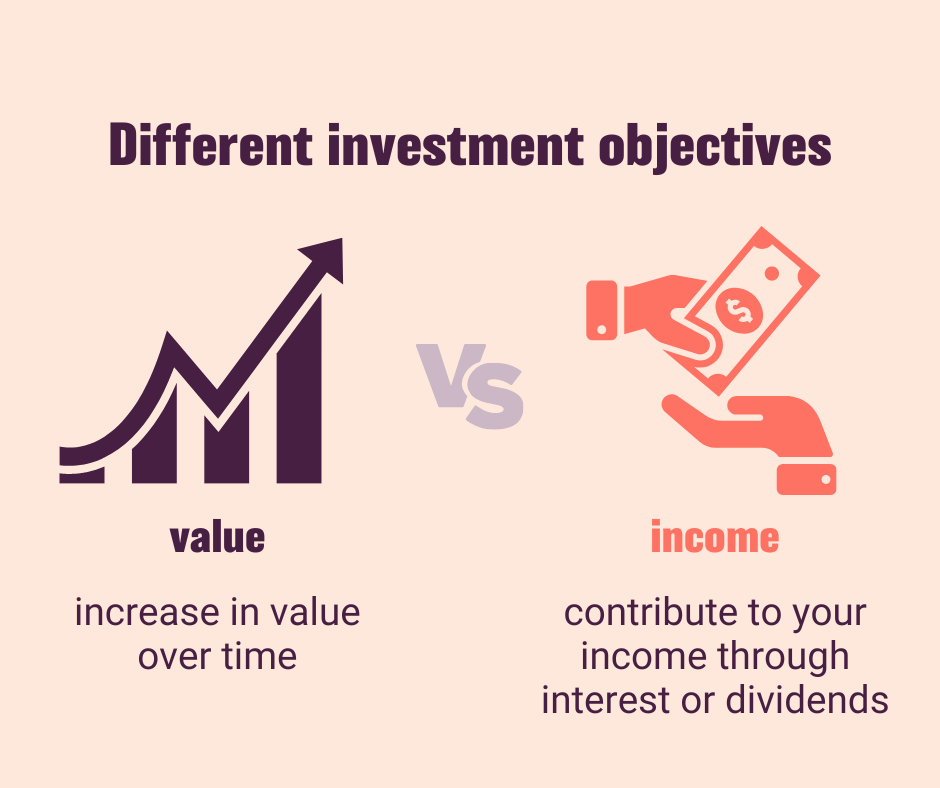

The basic options of what your investment should do for you are:

When you are looking to increase the value of your investments, you usually are investing for the long-term with stocks, commodities etc. and you want your fund or portfolio to re-invest any returns to benefit from the compound interest effect.

When you are investing to generate additional income, then you'll likely pick investments that pay out an interest or a dividend on a regular basis.

Tip 📌

What interests you as an investor might boil down to the following three questions:

- Is my investment generating an adequate return or income in relation to the risk I have to take?

- How much does my investment cost me?

- Is my money invested in line with my values and does it have a positive impact on the planet or people or both?

Finding your way through the provider and product jungle

Depending on which way you choose to invest, you then might need different further criteria that inform your choice, for example not all robo-advisors allow you to start with the same amount, some providers offer sustainable options and some don't, some are specialised in one thing only etc.

We try to make the way through the finance jungle as easy as possible and have prepared a number of resources for you.

How to select a robo-advisor

If you are thinking of going with a robo-advisor, here are a few questions to ask:

- What's the purpose of your investment (retirement, making an impact on the planet, general investing...)? Not all providers offer all things

- What is the amount you are investing? Many providers will have low starting amounts, but some might not

- Is the provider established, how long have they been in operation?

- How much money do they manage?

- How high are the fees?

- Is there any data available on the performance?

- What is the corporate philosophy of the robo-advisors? What team do they have and who is on it?

- Is the custody bank (where your money will managed) aligned to your values?

- What level of service will you get, e.g. is there a helpline or a chat to help you?

- Do you like the digital experience (test with a test account)?

To make it easier, download our checklist to have it at hand when you research your providers

Tip📌

One of the easier ways, especially when you are starting out, is to use comparison platforms such as robo-advisors.eu or investopedia and to read best-lists and reviews.

Download your checklist

Please login

Our contents are completely advertising free.

To benefit from full access to all of our lessons and webinars, please upgrade your account.

or join one of our live webinars with included 1 month premium access pass.

VIP Coaching is also available for

How do I find and compare funds and ETFs?

There’s a variety of platforms and financial providers that can help you choose the right ETF or fund for you. Some points to look out for are:

- Price

- Return on capital (past performance)

- Size and fluctuations

- Who is the provider/issuer?

- What criteria are used to create the ETF?

- Index composition

- Is there a sustainability focus?

- Is there a stock included that doesn’t align with your values?

- Are there any fees that you need to consider?

You find a lot of this information in the fund factsheet.

Tip📌

To find funds and ETFs, it helps to use comparison platforms. Not all of them are very user friendly, but they'll help you to find your way through the maze. For ETFs, we like justetf.com or trackinsight (allows to filter by the United Nations Sustainable Development Goals). You also find plenty of information on common platforms such as Yahoo Finance, Bloomberg and searching for terms like 'best performing ETFs'.

Download your checklist

Please login

Our contents are completely advertising free.

To benefit from full access to all of our lessons and webinars, please upgrade your account.

or join one of our live webinars with included 1 month premium access pass.

VIP Coaching is also available for

How do I assess a human advisor?

Please see module 7 for more detailed information on how to work with human advisors and what questions you can expect during the meeting.

To assess if an advisor is the right fit, we have a checklist for you.

Download your checklist

Please login

Our contents are completely advertising free.

To benefit from full access to all of our lessons and webinars, please upgrade your account.

or join one of our live webinars with included 1 month premium access pass.

VIP Coaching is also available for

Frequently asked questions

How do I read a product factsheet?

Please find an explainer video in the FAQs and Resources section of this module.

How can I assess if my product is delivering 'good' performance?

This is very hard to answer as it depends on the risk you are willing to take and the fees you are paying. And you'll only ever have historical data to go by, as past performance is no indication of future performance. An easy way to look at it is to either compare your fund with other similar products or to have a look at general economic market data of the market your fund is covering/investing. Has it been better than the market has been doing? Worse? If for example your fund returned a 5% increase and the overall market generated a return of 15% in the same time period, it might not be a super high flyer.

How can I assess if my provider is charging me a fair fee?

Comparing pricing when it comes to financial products is a maze most people struggle with. You either can go by a comparison platform or head to the FAQs and Resource section of this module for a short explainer video and the SmartPurse pricing calculator.