It took a long time to implement the much-debated option to make retroactive payments into Pillar 3a for missed contributions. But as of January 2025, it’s finally a reality. On November 6, 2024, the Federal Council decided that retroactive contributions to Pillar 3a would be permitted starting in 2025.

Under the new regulation, you can retroactively make contributions that you missed in the past ten years — provided certain conditions are met. This article explains what this could mean for you and what advantages such a retroactive Pillar 3a payment might offer compared to a voluntary purchase into your occupational pension fund (2nd Pillar).

This only applies to years in which you had income subject to OASI (Old Age and Survivors’ Insurance, 1st Pillar) in Switzerland. The catch-up amount is limited to the maximum annual contribution for employees with a pension fund — CHF 7,258 for 2025.

What's New

If you have an income subject to OASI (1st Pillar) contributions, you can currently pay up to a maximum amount each year into the Swiss Pillar 3a pension scheme. The maximum contribution for 2025 is CHF 7,258 if you are affiliated with a pension fund (i.e., employed), or up to 20% of your net annual income (but CHF 36,288 max) if you are self-employed without a pension fund. Contributions made to Pillar 3a can be deducted from your taxable income. When you withdraw the funds, they are taxed at a reduced rate.

Until now, retroactive payments into Pillar 3a were not allowed. If you missed a contribution in a given year or did not pay in the maximum amount, you could not make up for it later. This has now changed: Under the new regulation, you can make retroactive payments into your Pillar 3a account for up to ten years, provided certain conditions are met.

Conditions for making retroactive payments into Pillar 3a

- AHV-Contributory Income: Retroactive payments into Pillar 3a are only permitted for years in which you had income subject to AHV contributions within Switzerland.

- Full Regular Annual Contribution: You must have made the full regular contribution for the current year before you are eligible to make any retroactive payments.

- Maximum Retroactive Payment: Retroactive payments are allowed for up to ten years back, but only up to the low contribution limit — that is, the amount applicable to employees with a pension fund (e.g. CHF 7,258 in 2025). For example, if you do not pay the full amount in 2025, you may retroactively contribute the shortfall in 2026.

- Tax Benefits: Both regular contributions and retroactive payments can be deducted from your taxable income.

- First Retroactive Payment Possible in 2026: The first opportunity to make a retroactive payment will be in 2026 for the year 2025.

This new measure is particularly relevant for individuals who aren't able to contribute the maximum amount every year. However, it requires AHV-contributory income, and therefore excludes individuals with complete breaks in employment.

Pros and Cons of Retroactive Payments to Pillar 3a

Advantages:

- Tax Savings: Your contributions are deducted from your taxable income. The higher your income, the more tax you save. Example: If you live in a canton with a marginal tax rate of 30% and contribute CHF 7,258, you save around CHF 2,177 in taxes. By making retroactive payments, you could potentially multiply this effect over ten years.

- Investment Flexibility: You can choose how your money is invested. Securities-based solutions like ETFs often yield higher long-term returns than traditional savings accounts.

- Closing Pension Gaps: Many people are unable to contribute the maximum amount in their younger years or during periods such as starting a family. Retroactive payments allow you to close these gaps and strengthen your retirement savings sustainably.

- Favourable Tax Treatment on Withdrawal (Currently): Pillar 3a assets are currently taxed at a reduced rate when withdrawn. However, this may change in the future if tax rates are adjusted.

- Financial Security for Your Family: In the event of death, the accumulated capital goes to the beneficiaries you designate. This provides more control and security for your loved ones.

Disadvantages

- Limited amounts: Retroactive payments are capped at the lower contribution limit (applicable to employees with a pension fund). Self-employed individuals without a pension fund benefit less from this regulation.

- Funds are locked in: The money is generally tied up until retirement. You can withdraw from your Pillar 3a account no earlier than five years before the statutory retirement age, or under specific conditions such as purchasing residential property or permanently leaving Switzerland.

- Potential for higher taxation upon withdrawal: The favourable tax rates currently applied to Pillar 3a lump-sum withdrawals are not guaranteed. There is ongoing discussion about increasing these rates. The Federal Council plans to begin discussions on potential tax changes for Pillar 3a in 2025.

- Inflation risk with traditional savings accounts: Conventional 3a savings accounts often offer low interest rates. After accounting for inflation, the real value of your assets may decline unless you opt for securities-based investment solutions.

Which is better: Retrocative payment into Pillar 3a or pension fund?

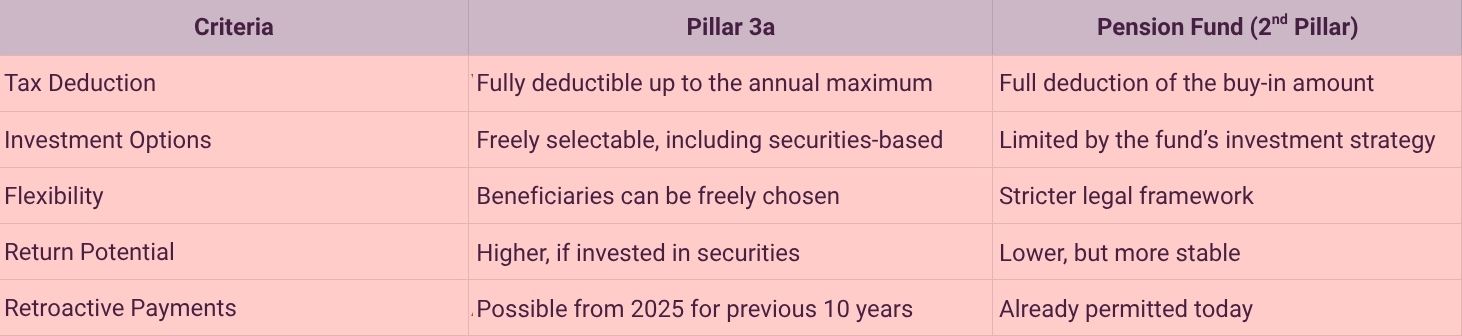

You might be wondering what’s more beneficial: making retroactive payments into Pillar 3a or buying into your pension fund (2nd pillar)? Both options offer tax advantages—but they differ significantly.

Here's a comparison:

How to get the most out of your Pillar 3a

- Contribute on time: To benefit from the tax deduction, your contribution must be received by December 31. Plan ahead and avoid last-minute payments to ensure it’s processed in time.

- Choose the right investment strategy: Consider whether a securities-based solution, such as ETFs, suits your risk profile and investment horizon. These offer higher long-term returns but come with market fluctuations.

- Maximise tax benefits: Calculate your potential tax savings. If you have a high income, making the maximum annual contribution can significantly reduce your tax burden.

- Check the fees: Be aware of the fees associated with your Pillar 3a product. High management or custody fees can eat into your returns over time—compare providers to find cost-effective options.

- Plan long-term Think strategically about your retirement planning over several years.

🔎 Looking for more detailed strategies? This article offers further insights on how to optimise your Pillar 3a.

Discover more

-

Die 10 häufigsten Fragen zur Säule 3a

Wir beantworten die 10 häufigsten Fragen zum Thema der Säule 3a. -

Wertschriften als Anlagemöglichkeit in die 3a Säule

Wir zeigen dir, wie du mit Wertschriften das Beste aus der Säule 3a holst. -

Säule 3a: Welche Art passt zu dir?

Welche Art von Anlage die richtige für dich ist, hängt bei der säule 3a auch von persönlichen Umständen ab, wie zum Beispiel bei u...