In this lesson you will learn 💸

- What a financial life cycle is

- How your financial life stage impacts your wealth over time

What are common life stages?

Although we can’t predict our future, or our finances, it is good to have a general idea of where you want to go, and what you could do to be financially prepared, no matter our age or life stage.

What is a wealth cycle?

Over your lifetime, there are two main phases in which you create and later on use your wealth:

- Accumulation phase: Once you’ve made your way through childhood and education, you transition to your adult life. On this journey, the hope is that the money you earn will exceed your expenditures.

- Distribution phase: when you stop working (for most of us, this is at retirement), the chances are that you’ll spend more each month than you have coming in. By the time you reach this phase, you’ll need to have enough saved to cover your living costs.

How do different life stages influence your finances?

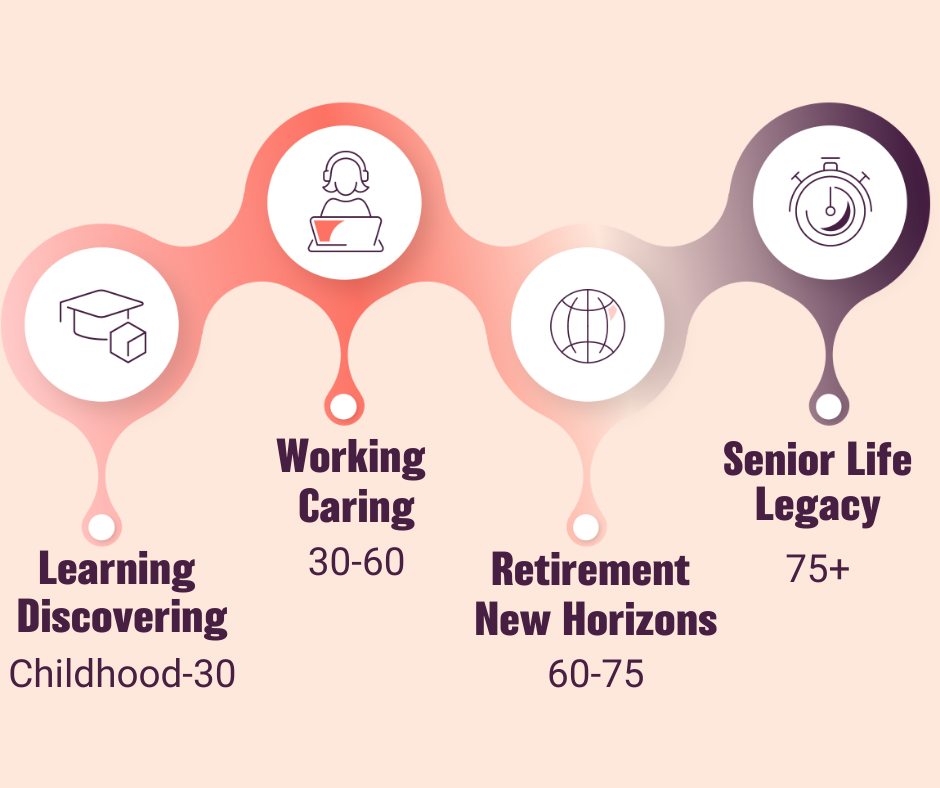

Let's have a quick look at the most common life events:

Discovering, learning and studying

This first major stage in life includes financial decisions about funding studies and personal development. This stage often has a significant impact on future opportunities for employment, pay and long-term finances.

Starting and returning to work

This includes either starting your first job, or returning to work (after for example, a career break or maternity leave), and takes into account financial topics that were already discussed in previous lessons, such as the gender pay gap.

Tip 📌

What matters for your future financial independence is to negotiate your pay well, regardless if you are starting to work, or re-starting, for example, after parental leave. When negotiating, it's not only about the figure on your bank account, but think pension contributions, any additional education as well as other benefits as well. 😉

Partnerships

Your finances play a large role in your relationship. Life events such as moving in with a partner, getting married, a divorce, or becoming a widow all have an influence on your financial future.

Tip 📌

It is worth booking a money date and doing your homework to develop a shared financial plan with your partner. Some points to consider are your legal rights, your budget and retirement plans, as well as your independence and contingency in case you will separate.

Parenthood and care

Starting a family, whether through childbirth, adoption, or any other way, includes many financial responsibilities, including the major one: raising a child.

Your finances might be impacted by returning to work part-time and facing lower pay as well as the growing cost of childcare. Your finances, however, might also be impacted by financing the cost of caring for older relatives.

Retirement and legacy

Women already live, on average, longer than men, and with life expectancy continuing to increase, that means the need for appropriate retirement planning is greater than ever ensuring that your pension is enough to provide the life you want, including potentially starting something completely new when you are older. Don't forget to take into consideration the growing cost of care.

That's why your financial plan is all about planning ahead. Your budget, which we'll look at in module three, will help you to make sure that you factor in the necessary amounts into your present spending.

Your action 📝

You might see yourself in a couple of these stages right now, what matters most for your financial independence is to plan ahead.

Ask yourself the following:

- Do I see any financial risks associated with my current life situation?

- Have I thought ahead considering any potential future events I might enter into?